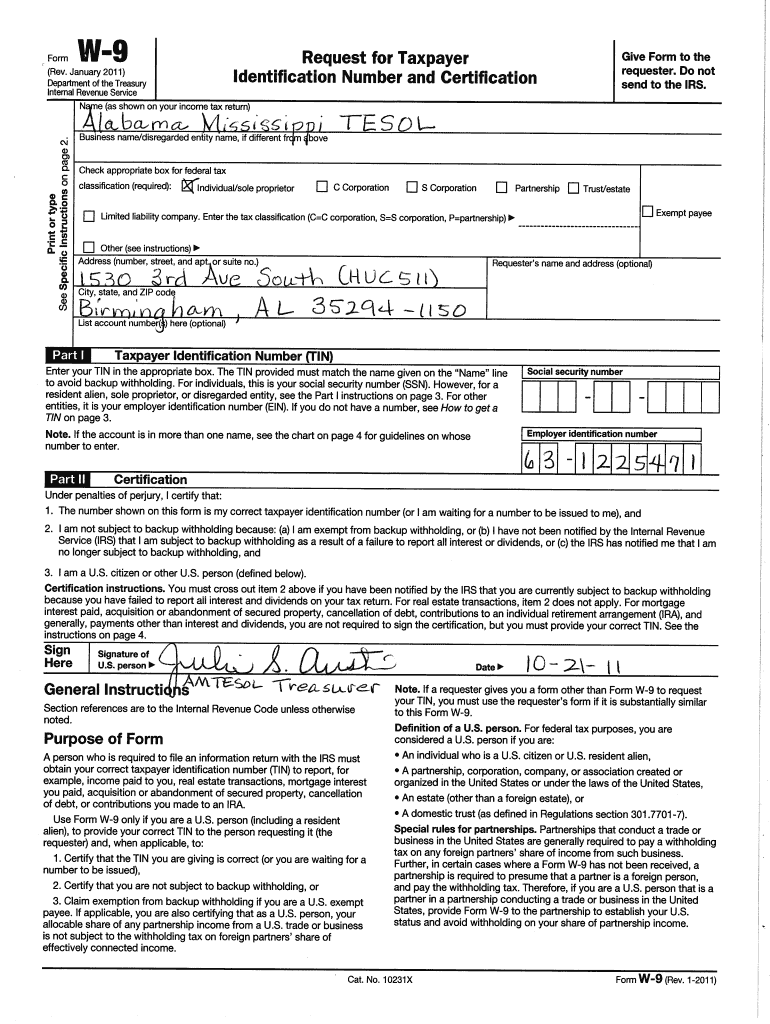

Who Gets A W9 Form – Acquisition or abandonment of secured property; The w9 is a formal request for information about the contractors you pay, but more significantly, it is an agreement with those contractors that you won’t be withholding income tax from their pay—contractors must pay their own taxes on this income. You need to use it if you have earned over $600 in that year without being hired as an employee. Resident alien who is relying on an exception contained in the saving clause of a tax treaty to claim an exemption from u.s.

Independent contractors who were paid at least $600 during the year need to fill out a. And contributions to an ira. If you are a u.s. The information on this form is.

Who Gets A W9 Form

Who Gets A W9 Form

Your entity type tells you if you’re paying an individual acting as a sole proprietor or a business entity and how it’s organized. This form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: You may have to include information such as your businesses’s entity type or ein.

Who has to fill it out?

Download Fillable W 9 Form Printable Forms Free Online

Blank W 9 Form 2021 Printable Irs Calendar Template Printable

What Is a W9 Form? (And How Do You Fill One Out?) The Smart Wallet

How To Fill Out W9 Form For A Single Member LLC in 2021?! Credit Viral YouTube

Fill And Sign W9 Form Online for Free DigiSigner

Free Online Fillable W9 Form Printable Forms Free Online

Free IRS Form W9 (2024) PDF eForms

W9 Form Basics for Small Business Owners Addify

Downloadable W9 Tax Form How To Fill Out A W9 Form Line W Calendar Printable Free

Quick Video on w9 Form 10 Most Important Things You Must Know

W9 Form Fill Out and Sign Printable PDF Template signNow

Pdf Fillable W9 Form Printable Forms Free Online

W9 Form 2023 Pdf Irs Printable Forms Free Online

How do I fill out IRS Form W9 for my IRA LLC? Rocket Dollar

Leave a Reply

You must be logged in to post a comment.