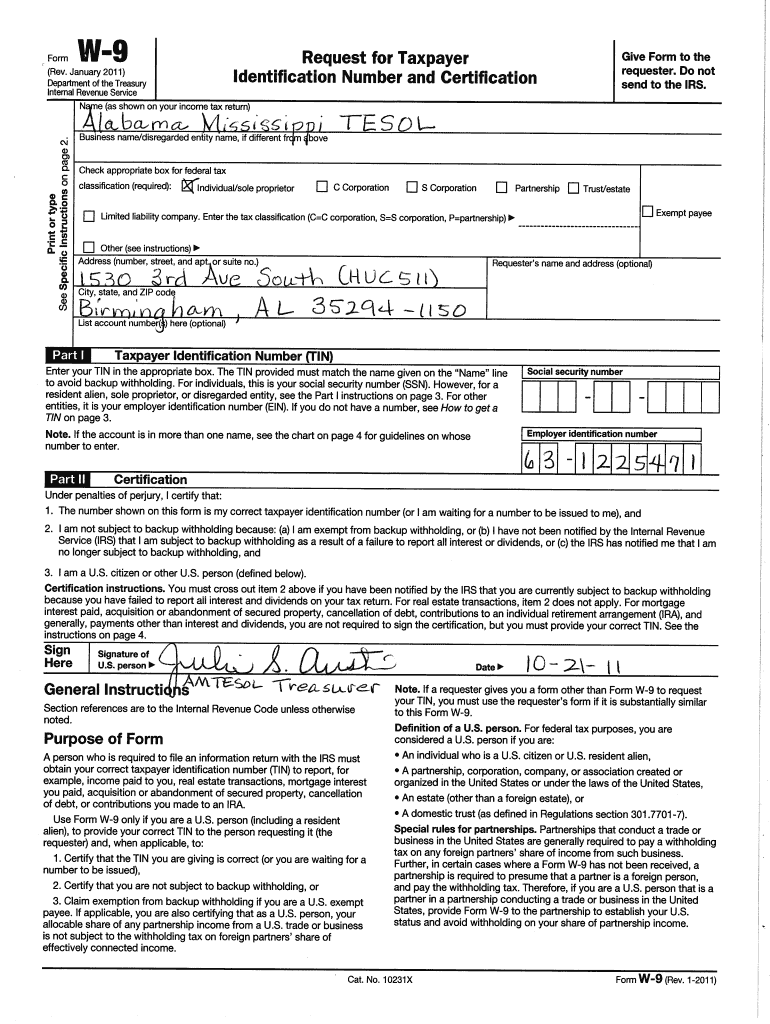

W9 Form 2019 Fillable Free – Write the name as shown on your income tax return. Prepare and file your federal income tax online at no cost to you (if you qualify) using guided tax preparation, at an irs trusted partner site or using free file fillable forms. Afterward, you can print or save the completed form on your computer or mobile to. If you are running a sole proprietorship you would enter your name.

Tax online at no cost to you (if you qualify) using guided tax preparation,. Free file fillable forms are electronic federal tax forms you can fill out and file online for free, enabling you to: Fillable form w9 (2019) request for taxpayer identification number and certification's one of the most commonly used irs forms. It is held for documentation purposes.

W9 Form 2019 Fillable Free

W9 Form 2019 Fillable Free

If you have a form 1040 return and are claiming limited credits only, you can file for free yourself with turbotax free edition, or you can file with turbotax live assisted basic. As an independent contractor, you’re required to pay. Fillable w 9 forms printable forms free online, understand the process for obtaining a.

4.7 stars | 13,345 ratings. Person (including a resident alien) and to request certain certifications and claims for exemption. Fill out the form and download your.

W9 Form 2019 Printable IRS W9 Tax Blank in PDF

Wisconsin w9 form Fill out & sign online DocHub

Pdf Fillable W9 Form Printable Forms Free Online

Fillable W 9 Tax Form 2019 Form Resume Examples X42MOdlYkG

W 9 Forms Printable 2019 Form Resume Examples G28B7lG1gE

Free Online Fillable W9 Form Printable Forms Free Online

2019 Form WI W9 Fill Online, Printable, Fillable, Blank pdfFiller

Fill And Sign W9 Form Online for Free DigiSigner

w9 forms 2019 printable PrintableTemplates

Fillable W 9 Tax Form Printable Forms Free Online

Wi W9 Printable Form Printable Forms Free Online

Pdf Fillable W9 Form Printable Forms Free Online

w9 forms 2019 printable PrintableTemplates

Printable W 9 Form Free Printable Forms Free Online

Leave a Reply

You must be logged in to post a comment.