Use Of Form W9 – Learn why and when you'll need this form and how to file it. Go to www.irs.gov/formw9 for instructions and the latest information. The form acts as an agreement that you, as a contractor or freelancer, are responsible for withholding taxes from your income. The w9 is a formal request for information about the contractors you pay, but more significantly, it is an agreement with those contractors that you won’t be withholding income tax from their pay—contractors must pay their own taxes on this income.

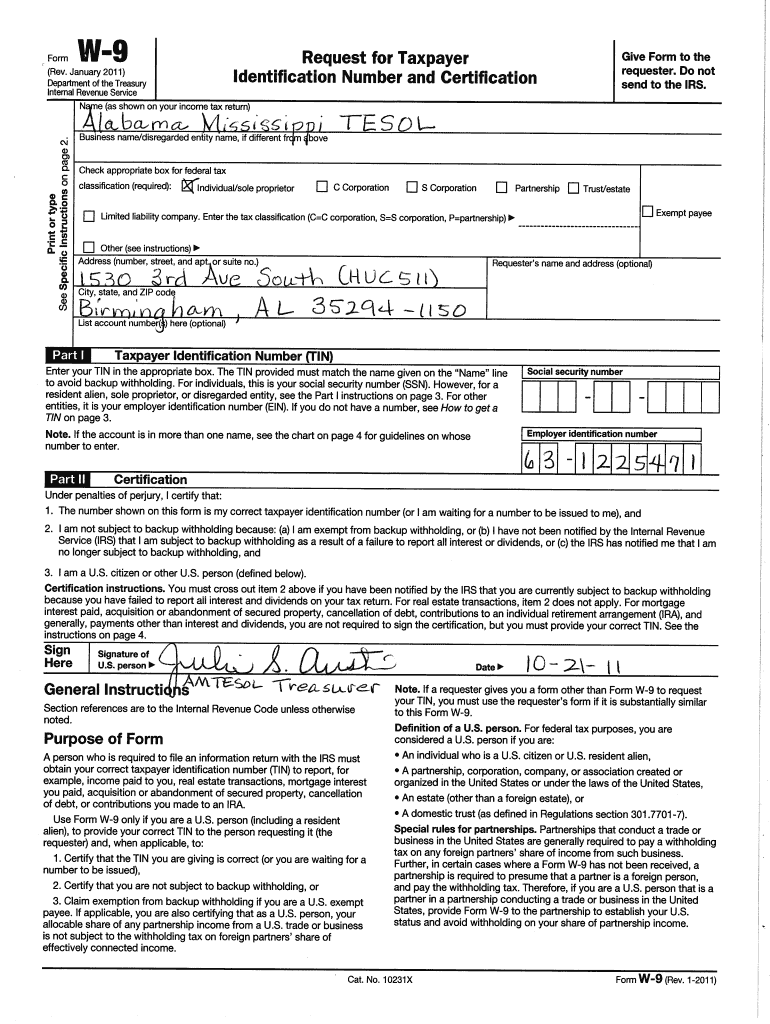

Request for taxpayer identification number and certification. Employers use this form to get the taxpayer identification number (tin) from contractors, freelancers and vendors. Acquisition or abandonment of secured property; Give form to the requester.

Use Of Form W9

Use Of Form W9

The form helps businesses obtain important information from payees to prepare information returns for the irs. It is also used to collect information from partnerships, corporations, companies, estates, or. And contributions to an ira.

This form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example:

W9 Form 2012 Complete with ease airSlate SignNow

Form W9 Request for Taxpayer Identification Number and Certification (2014) Free Download

W9 Request For Taxpayer Identification Number And Certification Pdf Free Printable W 9 Form

How to Submit Your W 9 Forms Pdf Free Job Application Form

What Is a W9 Form & How to Fill It Out

W9 Form 2012 Complete with ease airSlate SignNow

Free IRS Form W9 (2024) PDF eForms

W9 vs 1099 En Enkel Guide til Leverandøren Skatt Former Hippocrates Guild

W9 Form

Free Printable Job W9 Form Example Calendar Printable

Free Online Fillable W9 Form Printable Forms Free Online

Know The Use And Purpose Of W9 Form littlelioness

W9 Form Basics for Small Business Owners Addify

How To Fill Out W9 Form For A Single Member LLC in 2021?! Credit Viral YouTube

Leave a Reply

You must be logged in to post a comment.