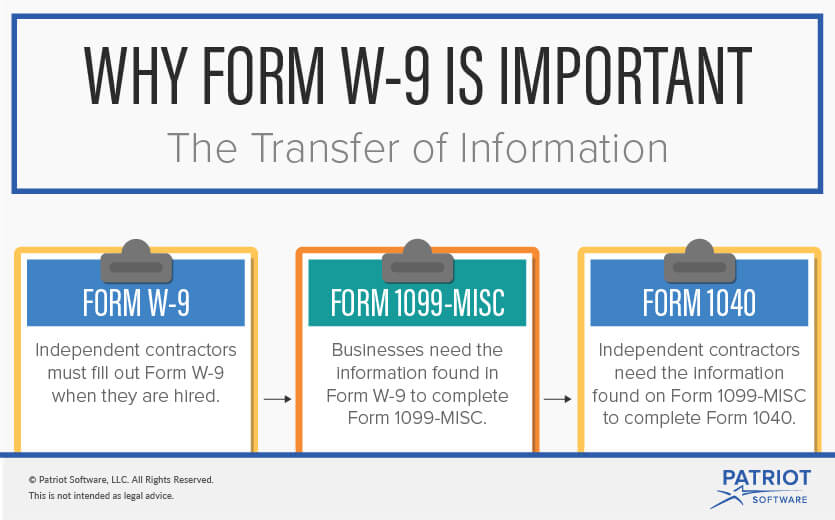

Purpose Of Form W9 – Independent contractors who were paid at least $600 during the. This form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: It lets you send your tax identification number (tin)—which is your employer identification number (ein) or your social security number (ssn)—to. This includes their name, address, employer identification number, and.

For guidance related to the purpose of form w. It is also used to collect information from partnerships,. Person (including a resident alien) and to request certain certifications and claims for exemption. Go to www.irs.gov/formw9 for instructions and the latest information.

Purpose Of Form W9

Purpose Of Form W9

The form acts as an agreement that you, as a contractor or freelancer, are responsible for withholding taxes from your income. Request for taxpayer identification number and certification. The w9 is a formal request for information about the contractors you pay, but more significantly, it is an agreement with those contractors that you won’t be withholding.

Form W9 India Dictionary

IRS Form W9 Purpose and When to Use It finansdirekt24.se

W9 Form 2024 To Print Camel Corilla

Form W9 Definition and purpose Outsource Accelerator

Why does seller fill out w9? real estate texas what do real estate agents use w9 form for

W9 Form Basics for Small Business Owners Small Business Trends

Fillable W9 2022

Form W9 Definition and purpose Outsource Accelerator

Free IRS Form W9 (2024) PDF eForms

2022 W9 Form Printable W9 Form 2022 (Updated Version)

All about W9 Form What It Is, What It Is Used for, and How to Fill It Out

How to complete IRS W9 Form W 9 Form with examples YouTube

Know The Use And Purpose Of W9 Form littlelioness

What Is Form W9? Purpose and When to Use It

Leave a Reply

You must be logged in to post a comment.