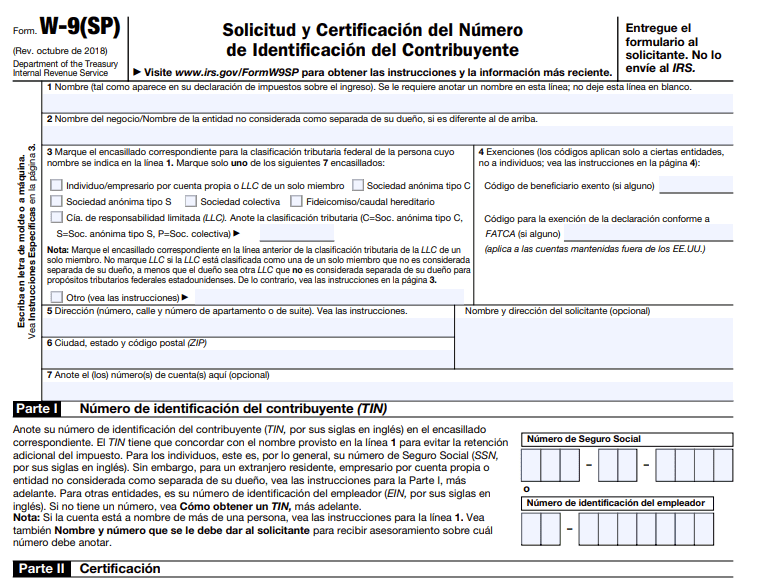

Forma De Taxes W9 – This form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: Contained in the saving clause of a tax treaty to claim an exemption from u.s. Generally, this must be the same treaty under which you claimed exemption from tax as a nonresident alien. The form acts as an agreement that you, as a contractor or freelancer, are responsible for withholding taxes from your income.

Independent contractors who were paid at least $600 during the year need to fill out a. The information provided on form. It is commonly required when making a payment and withholding taxes are not being deducted. Acquisition or abandonment of secured property;

Forma De Taxes W9

Forma De Taxes W9

Contained in the saving clause of a tax treaty to claim an exemption from u.s. Generally, this must be the same treaty under which you claimed exemption from tax as a nonresident alien. And contributions to an ira.

Cómo crear un W9 Impuestos 2023

Fill And Sign W9 Form Online for Free DigiSigner

What Is a W9 Tax Form? H&R Block

Forma W9 Para Imprimir Printable Blank PDF Online

W9 USA federal tax form Stock Photo Alamy

El formulario W9 del IRS y Cual es Su Uso YouTube

Como llenar W9 el Formulário W 9 How to complete a IRS W9 Form La Forma W 9 YouTube

La Forma W9 Francisco Garcia de Quevedo, CPA (Contador Público Autorizado)

Como rellenar la forma W9? W9 Tax Form Paso a Paso YouTube

How to Complete an IRS W9 Form YouTube

Free IRS Form W9 (2024) PDF eForms

¿Quién debe completar el formulario W9 del IRS?

How to complete IRS W9 Form W 9 Form with examples YouTube

IRS W9 FORM STEPBYSTEP TUTORIAL How To Fill Out W9 Tax YouTube

Leave a Reply

You must be logged in to post a comment.